Jan 2022 Newsletter

The print version of our newsletter can be found here (PDF). The full version of the newsletter includes:

How to use Remote Deposit

How to Set up Push Notifications

Winter Loan Rates

4th Quarter Savings Rates

Fraud Alert: Phone Spoofing

Fraud Alert: Phishing Scams

Highlights are below:

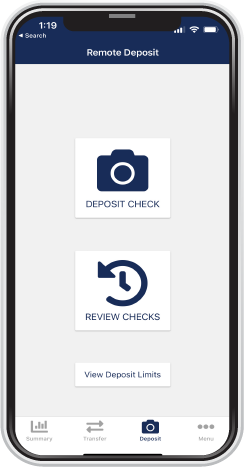

How to Use Remote Deposit:

If you do not see this function when using our mobile app, please call us at 765-962-3172.

1. Deposit your paper checks using our mobile banking app! Before depositing, please endorse the back of the check with the following:

Your Signature

For Mobile Deposit Only at HCPFCU

2. Open our mobile banking app. Click on the camera icon across the bottom panel that says “deposit”. Follow the prompts to take a picture of the front and back of the check.

3. Deposit Details: On this screen, you will need to “Select Suffix” (Choose which account to deposit the funds to) and confirm the amount being deposited.

4. Review & Deposit: The screen will show a summary of the transaction. Click deposit to continue.

5. Agree to the remote deposit terms to finalize the deposit. You will get a notification when the deposit is accepted.

Note: Keep the check in a safe place for at least 15 days in case we need you to present the physical check. After 60 days, destroy or properly dispose of the check.

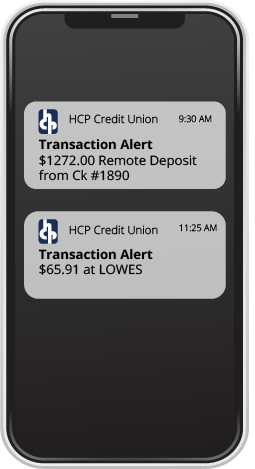

How to Set Up Mobile Push Notifications

1. Launch our mobile banking app

2. Click on "menu" in the bottom right corner

3. Then scroll to "Services" and click on "Notifications"

4. Click on "Enable Notifications"

5. Choose your parameters, such as balance alerts,

transaction alerts, etc

Phone Spoofing of HCP Credit union Members

There has been an increase in fraudulent phone calls affecting our members! The calls appear to be from our credit union that can put your account and funds at risk! It’s called Caller ID spoofing. Caller ID spoofing is the process of changing the Caller ID to any number other than the actual calling number. The caller intentionally disguises their real phone number.

How can you stop spoofing calls? While there’s nothing you can do to stop them, there are three very important steps you can take to prevent being a victim:

If in doubt, don’t answer it. You can call the number directly later to see if it was a real person or company.

Be diligent! Even if your caller ID shows a familiar number (perhaps a local area code), assume it is not a legitimate call. Be very cautious about giving any information to an unsolicited caller. If you are unsure, hang up, and call the person or business directly.

Block the calls. Check with your phone carrier to see if they have a spam filter.

Here’s an example of what has been happening: A member received a call that was spoofed with HCP's actual phone number stating that their debit card was in jeopardy of fraud (the spam caller created urgency.) The spammer stated that he would cancel the member’s card immediately, and expedite a new card the next day but wanted to verify the card number, account number, PIN number as well as other personal information.

PLEASE NOTE: HCP Credit Union will NEVER initiate a call to ask for your account number, card number and PIN number - we already have all that information.

If you receive a call similar to this, and you’re not sure it’s from us, hang up and call us directly regarding your account. And remember, you can manage your account directly with our Mobile App. It will send instant alerts for any transaction and allows you to remotely turn your debit card on and off for security.

AVOID Phishing SCAMS

Scammers also use email or text messages to trick you into giving them your personal information. They may try to steal your passwords, account numbers, or Social Security numbers. If they get that information, they could gain access to your email, bank, or other accounts. Scammers launch thousands of phishing attacks like these every day — and they’re often successful. The FBI’s Internet Crime Complaint Center reported that people lost $57 million to phishing schemes in one year.

Phishing emails and text messages may look like they’re from a company you know or trust. They may look like they’re from a bank, credit union, a credit card company, a social networking site, an online payment website or app, or an online store.

Phishing emails and text messages often tell a story to trick you into clicking on a link or opening an attachment. They may...

• say they’ve noticed some suspicious activity or log-in attempts

• claim there’s a problem with your account or your payment information

• say you must confirm some personal information

• want you to click on a link to make a payment

• say you’re eligible to register for a government refund

• offer a coupon for free stuff

What To Do if You Suspect a Phishing Attack: If you get an email or a text message that asks you to click on a link or open an attachment, answer this question: Do I have an account with the company or know the person that contacted me?

If the answer is “No,” it could be a phishing scam. The best approach it to delete the message.

If the answer is “Yes,” contact the company using a phone number or website you know is real. Not the information in the email. Attachments and links can install harmful malware.

Derived from www.consumer.ftc.gov